7 Essential Questions to Ask Before Choosing a Commercial Loan Origination Software

- October 29, 2023

- 2 minutes

The advent of technology in the commercial lending industry has brought about a plethora of choices in commercial loan origination software. This software assists lenders in streamlining their workflow, improving operational efficiencies, and promoting a better client experience. However, the selection of an optimal software solution requires a thoughtful and methodical approach. To aid you in such an endeavor, here are seven cardinal questions you should consider.

-

Can the Software Be Customized to meet your Specific Needs?

Commercial loan origination involves a complex process, influenced by a myriad of factors that vary from one firm to another. These could range from portfolio diversity to risk tolerance levels or regulatory compliance requirements. Therefore, it is paramount to choose a software solution that can be tailor-made to suit your unique business needs. A customizable software solution provides the flexibility to tweak the system according to your evolving requirements and thereby ensures a high return on investment.

-

Does the Software Have a User-friendly Interface?

The complexities of commercial loan origination call for a software solution that is straightforward and easy to navigate. A software solution with a cluttered and complex interface can hinder productivity and lead to inefficiencies. Therefore, it is important to choose a solution with an intuitive interface that is simple for your team to use and decreases the learning curve.

-

What is the Software's Scalability?

As your business grows, your needs are likely to change. A software solution that cannot scale with your growth will quickly become a bottleneck. Therefore, the software's capability to handle an increase in loan volume, add new functionalities, and accommodate additional users should be considered.

-

Can the Software Integrate with your existing Systems?

Today's lending environment often involves utilizing a multitude of systems. Your commercial loan origination software should function as the nucleus of these systems. It should flawlessly integrate with your existing infrastructure such as Customer Relationship Management (CRM), Loan Servicing, and Accounting systems to facilitate seamless data flow, thereby enhancing operational efficiency.

-

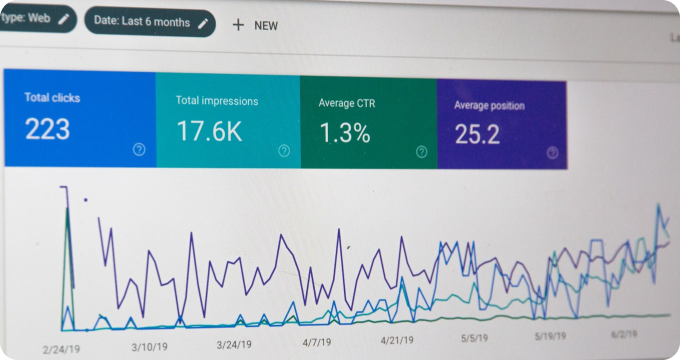

How Robust are the Software's Reporting and Analytics Capabilities?

The ability to accurately track and analyze loan portfolio performance is essential in making informed lending decisions. A software that provides comprehensive reporting and analytics capabilities can help in identifying trends, predicting future performance, and making strategic decisions. Therefore, ensure the software solution you choose provides detailed reports and has robust analytics capabilities.

-

What is the Vendor's Track Record and Level of Support?

The vendor’s reputation and the level of support they provide are crucial factors. Check the vendor’s track record in terms of software deployment success, client satisfaction, and their responsiveness to issues. A vendor offering round-the-clock support will ensure minimal disruption in your operations.

-

What is the Total Cost of Ownership (TCO)?

The TCO involves not just the upfront cost of the software, but also ongoing maintenance, upgrade costs, and the cost of additional services. It is crucial to understand the TCO to evaluate whether the software fits into your budget.

To conclude, choosing a commercial loan origination software is not a task to be taken lightly. It requires a deep understanding of your business needs, thorough market research, and careful evaluation of potential options. By asking these essential questions, you can make an informed decision and select a software solution that aligns with your business objectives, thereby improving your operational efficiency, enhancing your decision-making capabilities, and ultimately contributing to your success in the competitive world of commercial lending.

Learn More

Unleash the potential of your business by diving deeper into our blog posts, where you'll discover the transformative power of commercial loan origination software. For an unbiased, comprehensive view, they are encouraged to explore our meticulously curated rankings of the Best Commercial Loan Origination Software.

Popular Posts

-

Commercial Loan Origination Software Industry Report: Key Findings and Crucial Insights

Commercial Loan Origination Software Industry Report: Key Findings and Crucial Insights

-

The Future of Commercial Loan Origination Software: Predictions and Emerging Trends

The Future of Commercial Loan Origination Software: Predictions and Emerging Trends

-

Ask These Questions to a Commercial Loan Origination Software Provider to Choose the Right One for Your Business

Ask These Questions to a Commercial Loan Origination Software Provider to Choose the Right One for Your Business

-

How to Select the Right Commercial Loan Origination Software for Your Business

How to Select the Right Commercial Loan Origination Software for Your Business

-

4 Things I Wish I'd Known About Commercial Loan Origination Software Before Implementing It

4 Things I Wish I'd Known About Commercial Loan Origination Software Before Implementing It