11 Compelling Reasons Why Your Business Needs Commercial Loan Origination Software

- December 17, 2023

- 2 minutes

In an increasingly digital landscape, businesses are continuously seeking ways to streamline processes, increase efficiency, and ultimately, stay ahead of the competition. One field where this digital revolution is keenly felt is in the domain of commercial lending. For businesses operating in the financial services sector, the adoption of Commercial Loan Origination Software (CLOS) is fast becoming an essential strategic move. Here are 11 compelling reasons why your business needs to consider implementing CLOS.

-

Streamlined Loan Origination Process: The essence of CLOS lies in its ability to streamline the entire loan origination process – from application to decision-making, to the final disbursement of funds. By eliminating manual tasks and paperwork, the software significantly reduces the time taken to process loan applications, leading to increased efficiency and productivity.

-

Improved Risk Assessment: The software deploys advanced algorithms that can analyze a vast array of data points, predicting potential defaults and assessing the borrower's repayment capacity with greater accuracy.

-

Enhanced Customer Experience: In our tech-driven era, customers demand swift, seamless, and personalized services. A CLOS can meet these expectations by providing quick loan approvals, personalized loan products, and a user-friendly interface.

-

Regulatory Compliance: A well-designed software ensures compliance with evolving regulatory norms by automating compliance checks and providing real-time updates about any changes in regulations.

-

Data Security: Given the sensitive nature of financial data, the robust security measures integrated into CLOS provide a safe environment for data storage and transactions.

-

Cost-Effectiveness: Despite the initial investment, the long-term cost savings realized in terms of reduced manpower, lesser processing times, and minimized human errors make CLOS a cost-effective solution.

-

Scalability: With the ability to handle growing volumes of loan applications without compromising on efficiency, a robust CLOS provides a scalable solution for businesses anticipating growth.

-

Interoperability: The ability to integrate with other software systems, such as customer relationship management (CRM) and business intelligence (BI) platforms, enhances the value delivered by a CLOS.

-

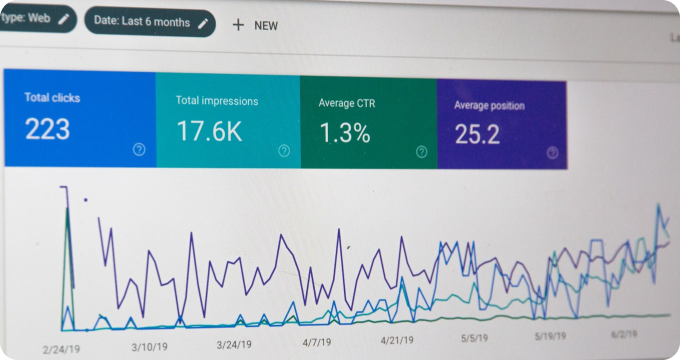

Real-time Analytics and Reports: By providing real-time analytics and reports, the software enables lenders to make informed decisions, identify trends, and devise effective strategies.

-

Customization: CLOS can be customized to suit specific business requirements, thus ensuring a tailored solution that perfectly matches the unique needs of each individual business.

-

Competitive Advantage: Lastly, a business equipped with a high-quality CLOS stands out amongst its competitors, paving the way for increased market share, customer loyalty, and higher profits.

Now, the adoption of such advanced technology is not without its tradeoffs. The initial capital outlay could be substantial, and businesses would need to invest in training their employees to use the software effectively. However, the benefits of implementing CLOS far outweigh these initial challenges.

As Harvard's own Clayton M. Christensen pointed out in his theory of disruptive innovation, businesses that fail to adapt to changing technologies risk being left behind. In the context of commercial lending, CLOS represents this disruptive technology. Fundamentally, it's not just about streamlining processes or enhancing efficiency, but about staying relevant in a rapidly evolving business landscape.

To conclude, CLOS is a compelling proposition for any business in the commercial lending space due to its ability to streamline operations, enhance efficiency, ensure regulatory compliance, and deliver a superior customer experience. As the world moves deeper into the digital age, businesses that choose to ride the wave of technological advancement will undoubtedly emerge as leaders in their respective domains.

Learn More

Unleash the potential of your business by diving deeper into our blog posts to discover the transformative power of commercial loan origination software. For an unbiased, comprehensive view, they are encouraged to explore our meticulously curated rankings of the Best Commercial Loan Origination Software.

Popular Posts

-

Commercial Loan Origination Software Industry Report: Key Findings and Crucial Insights

Commercial Loan Origination Software Industry Report: Key Findings and Crucial Insights

-

The Future of Commercial Loan Origination Software: Predictions and Emerging Trends

The Future of Commercial Loan Origination Software: Predictions and Emerging Trends

-

Ask These Questions to a Commercial Loan Origination Software Provider to Choose the Right One for Your Business

Ask These Questions to a Commercial Loan Origination Software Provider to Choose the Right One for Your Business

-

How to Select the Right Commercial Loan Origination Software for Your Business

How to Select the Right Commercial Loan Origination Software for Your Business

-

4 Things I Wish I'd Known About Commercial Loan Origination Software Before Implementing It

4 Things I Wish I'd Known About Commercial Loan Origination Software Before Implementing It